Table of Contents:

Skin In The Game—

“With it. Or on it.”

Antifragile, Black Swans, and The Incerto Series

Skin In The Game

Four Topics of Consideration

1) Bullshit Detection

2) Symmetry in human affairs

3) Information sharing in transactions

4) Rationality in complex systems

What Lindy Told Us

Text (1 book, 1 paper)

Audio (5 pieces of content)

Video (5 pieces of content)

What’s Next?

Reading Time: 15-20 minutes (Read sections you find intriguing, bookmark the media/links, and come back to anytime.)

Skin In The Game—

Abstract: “Skin In The Game” is a multilayered & continuously evolving aphorism about viewing the world through incurred risk to yourself and others. Risk *should* be shared more symmetrically. If we look at history, then systems that evolve, and thus survive, fundamentally have “Skin In The Game” characteristics.

—

"With it. Or on it." —

The above saying supposedly goes back to ancient Greece and recently made a cameo in the movie300. Parting mothers would basically cry “Come back with your shield, or on it” to their sons heading off to war. The premise being - dying in battle was the noblest of deaths. “Mothers whose sons died in battle openly rejoiced, mothers whose sons survived hung their heads in shame…

Asked why it was dishonorable to return without a shield and not without a helmet, the Spartan king, Demaratos (510 - 491) is said to have replied: "Because the latter they put on for their own protection, but the shield for the common good of all." (Plutarch, Mor.220 & 241)”

The now re-popularized phase is a good primer for our current essay’s subject matter. A helmet to the ancient Spartan was a necessary protection for the individual, but the shield was a symbol for the “common good.”

So, what is the common good exactly?

Dishonor, especially in battle or in death, was so taboo in Spartan culture that doing the opposite, acting honorably in battle or death, was the only *real* way to live. Anything short of this standard would probably mean death, or possibly exile, but most definitely shame. Still to this day, we remember the Spartans for their ferocious courage at the Battle of Thermopylae, but how do you get ~300 humans to literally die for their beliefs? The ancients knew something intuitively about “Skin In The Game” (SITG), as they applied the principle to war strategy that trickled down into everyday life and culture.

Collective behavior doesn’t flow from individual behavior because of the increasingly interconnected asymmetries in life.

BUT, when you create a “culture” of symmetry, the sum total of individual behaviors moves toward a better collective behavior with a longer survival time. (The initial goal direction of honor in this example that is.)

—

Antifragile, Black Swans, & The Incerto Series —

SITG is the 5th installment of Nassim Nicholas Taleb’s Incerto series, “an investigation of opacity, luck, uncertainty, probability, human error, risk, and decision-making in a world we don’t understand.” “In a world we don’t understand” is the key to this particular essay. Incerto means “uncertainty” in Latin.

Consider the following questions for yourself, and then for society:

How best should I make decisions? Should those answers differ when dealing with myself compared to others?

Am I ever *only* making decisions for myself or my circle, family, and tribe?… Or am I, and my decisions, *always* affecting others? Are their decisions affecting me?

How does society move toward a more symmetrical, and thus beneficial, outcome through the sum total of ALL decisions from ALL individuals?

Are there unifying principle(s) or heuristics in dealing with reality to answer these questions?

Taleb’s answer is his Incerto series. My answer is what you are currently reading.

What is your answer?

Before we go deeper into SITG, it is beneficial to bring up two topics of other Incerto books, AntiFragile & Black Swan (events), that our current topic of investigation builds upon.

The 2008 sub-prime mortgage crisis and the Fukushima nuclear reactor disaster in Japan (even Chernobyl, and the recent HBO series effectively critiquing what can happen when you don’t heed these principles) are catastrophic events that are unpredictable as specific occurrences but are predictable as rare-but-known phenomena. These events are called “Black Swans.” The only way to avoid Black Swans, is to give structures resilience, or “Antifragility.”

Taleb describes structures with antifragile characteristics as the ability to fail in small doses, and to use that failure to “gain from disorder” over time—counterintuitively producing a greater order. These principles would in theory, and, as we will see soon also in practice, impart resiliency to the structure, so that the system has the ability to transmit lessons from those small failures (by learning, adapting, and evolving) into developing new strengths.

Keeping things “small enough to fail” (as opposed to “too big to fail”) is the cornerstone. The 2008 financial crisis, and its “too big too fail” banks, was a prophetic moment for all of modernity in that it showed precisely what’s going on in too many places today. Bacon’s Rebellion says more about what kind of fragile world this creates when Black Swans appear :

“The result of this dynamic is that there is very little learning within the system, and we go right back to making structures that are more unstable over time. In evolutionary terms, we are not advancing into greater resilience, but lesser resilience.

Thus, instead of creating a world in which the most destructive Black Swans are more survivable, all the emphasis is on preventing such Black Swans, and creating an unsustainable state of normality. The inevitable result is that these Black Swans come anyway—with ever more catastrophic results.”

—

Skin In The Game —

Taleb suggests that today’s society at large is dominated by a culture of specialists who are rewarded for excessive intervention and for predictions that are routinely inaccurate. Bacon’s rebellion reveals how this has devastating consequences:

“The big reward for them is not in creating antifragility or even resilience, but stability—or rather, the temporary appearance of stability. Then, when disaster strikes, these specialists, who have very little “skin in the game,” pay a very small price, if any.

How many systems that you know of are dominated by ideologues and so-called experts with no skin in the game — people who suffer no repercussions from their failed prescriptions, who pass on the cost of their failures to the public, and who are insulated from the evolutionary process that weeds out failures?…

We see these “too big to fail” and “too big to learn” phenomena in system after system. We see them in central bank policies around the world. Central bankers are so terrified by the prospect of a recession that they continually pump more credit into financial systems, guaranteeing a bigger and more catastrophic crash down the road. We see it in California’s fire-fighting policies that suppress small wildfires but build up fuel for catastrophic wildfires. We see it in top-down social engineering policies and in special interest-driven land-use policies.”

When you put together structures that are resilient (AntiFragile) and that legitimately account for unlikely events (Black Swans) by actually planning for them rather than ignoring them until they become catastrophic, you will inevitably create SITG characteristics within said structures.

It may seem counterintuitive, but the economic theory underlying all of behavioral economics is just plain wrong. Behavioral economics takes into account singular plays (doesn’t consider time), but evolutionary economics (considers time) “takes the passage of previous events and does not take the characteristics of either the objects of choice or of the decision-maker as fixed.”

The former of the two is static, and Taleb says in his own words that incentives are NOT enough!

“What is Skin in the Game? The phrase is often mistaken for one-sided incentives: the promise of a bonus will make someone work harder for you. For the central attribute is symmetry: the balancing of incentives and disincentives, people should also be penalized if something for which they are responsible goes wrong and hurts others: he or she who wants a share of the benefits needs to also share some of the risks."

SITG is about suffering (that is a charged word nowadays) and evolution (again, a loaded term in today’s world). We are effectively filtering people out of the system through a “meta-rationality." Filtering is necessary for the function of basically everything.

You can see this quite clearly by asking a question: “Why, on high-speed highways are there surprisingly few rogue drivers who could, with a simple maneuver, kill scores of people?” Taleb answers with a pithy response:

“Well, they would also kill themselves and most dangerous drivers are already dead (or with [a] suspended license). Driving is done under the skin in the game constraint, which acts as a filter. It’s a risk-management tool by society, ingrained in the ecology of risk-sharing in both human and biological systems. The captain who goes down with the ship will no longer have a ship. Bad pilots end up at the bottom of the Atlantic Ocean; risk-blind traders become taxi drivers or surfing instructors (if they traded their own money).”

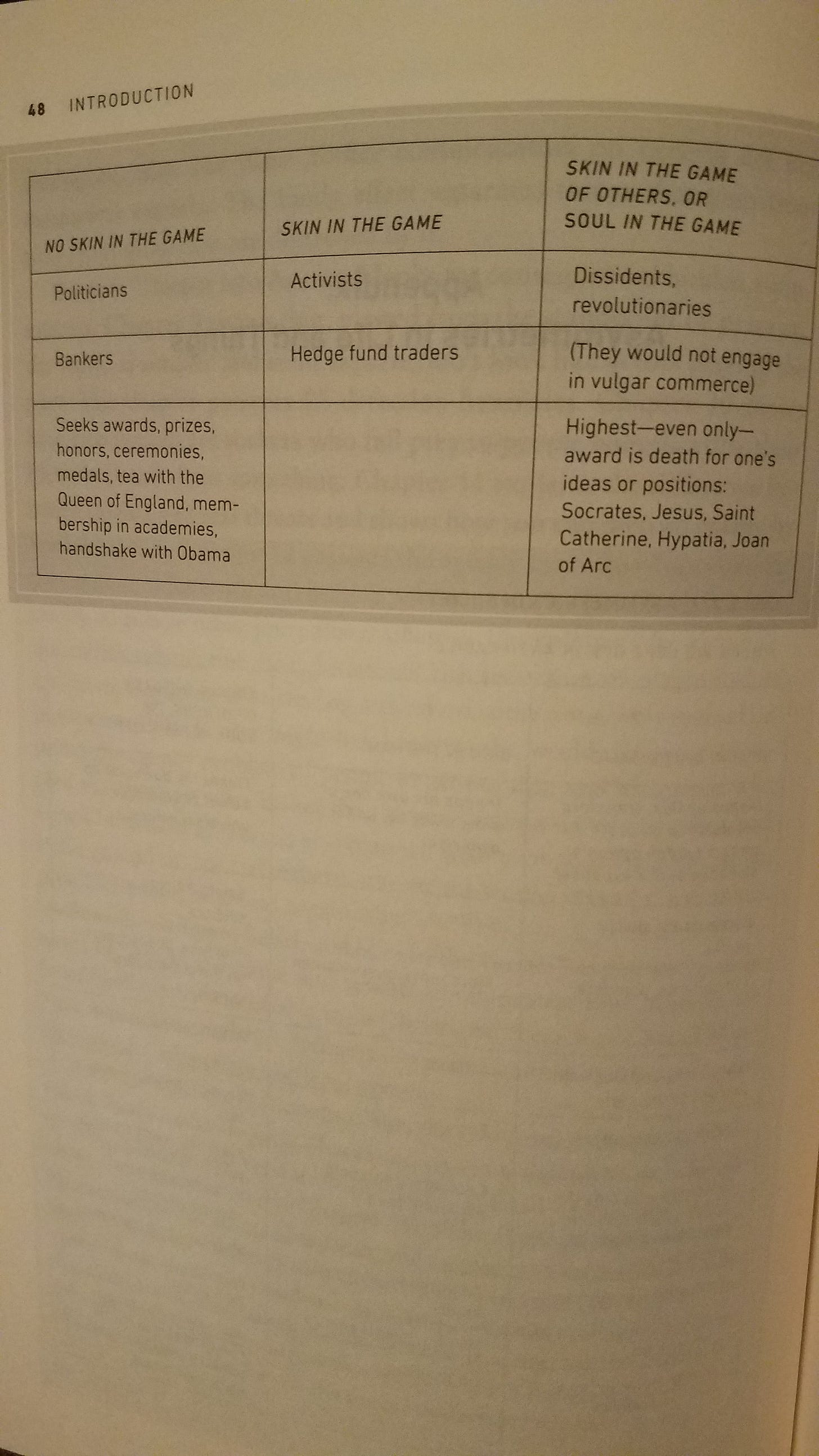

SITG is not simply about decision making. It is really about symmetry. Below is a graphic of sorts on who has “No Skin in the Game,” “Skin in the Game,” AND most importantly “Skin in the Game of Others, or Soul in the Game.”

How many people, institutions, or governments are on the left side and NOT on the right side?

(Side Note: Hypatia is the left-handed holographic bust on the Eclectic Spacewalk logo)

—

Four Topics of Consideration

Next, we focus on the surprising implications of the hidden asymmetries that do not immediately come to mind as well as the less obvious consequences.

“The same logic mysteriously answers many vital questions, such as (1) the difference between rationality and rationalization, 2) that between virtue and virtue signaling, (3) the nature of honor and sacrifice, (4) Religion and signaling (why the pope is functionally atheist) 5) the justification for economic inequality that doesn’t arise from rent-seeking, (6) why to never tell people your forecasts (only discuss publicly what you own in your portfolio) and, (7) even, how and from whom to buy your next car.”

The four topics that cannot be disentangled if one has SITG are as follows:

Bullshit Detection - Uncertainty and the reliability of knowledge

This is the difference between theory and practice, cosmetic and true expertise, and academia and the real world. We know in the abstract that everything is fundamentally uncertain to an extent dependent on the knowledge and its reliability on the subject in question. It just depends on your time horizon.

“Anything that smacks of competition destroys knowledge” and “Contemporary peers are valuable collaborators, NOT final judges”

Time is the only *real* judge, and we should construct systems that take time into account with uncertainty at its core - I mean, we literally live in an uncertain reality... We can only detect bullshit with the help of (usually) better information and the passage of time.

“Karl Popper’s idea of science is an enterprise that produces claims that can be contradicted by eventual observations, not a series of verifiable ones: science is fundamentally nonconformity, NOT confirmatory.”

Symmetry in human affairs - Fairness, Justice, Responsibility, and Reciprocity

This is sharing the responsibilities for events and their consequences.

Women’s reproductive rights in 2019 are STILL asymmetrical. Humans who don’t have female reproductive organs are making decisions that directly affect humans that do have female reproductive organs. No wonder the United States has the worst rate of maternal deaths in the developed world. Are any of the administrators who crafted the policies that led us into this mess going to be held accountable? As of now, that is a big fat NEGATIVE!

War hawks in Washington and Brussels (in air-conditioned rooms) that make decisions about the lives of thousands to millions in the Middle East, and elsewhere around the world, are engaging in NON-SITG activities as they have *no real repercussions* for their activities. Everyone else pays the cost, while the neocons aren’t punished for their mistakes. This leads to our current foreign policy conundrums across the globe. Again, are any of the people who led us into the multi-decade conflicts in Iraq and Afghanistan ever going to face the music? Not looking too good on that front!

The Intellectual Yet Idiot (as Taleb describes them) mistakes absences of evidence for evidence of absence. Historically, the IYIs have been wrong on: “Stalinism, Maoism, GMOs, Iraq, Libya, Syria, lobotomies, urban planning, low-carbohydrate diets, gym machines, behaviorism, trans-fats, Freudian-ism, portfolio theory, linear regression, High Fructose Corn Syrup, Gaussian-ism, Salafism, dynamic stochastic equilibrium modeling, housing projects, marathon running, selfish genes, election-forecasting models, Bernie Madoff (pre-blowup), and p-values." Yet, the IYI is still convinced that their current position is right.

Information sharing in transactions

“No person in a transaction should have certainty about the outcome while the other [person in the transaction] has uncertainty” & “Compendiaria res improbitas, virtusque tarda - the villainous takes the short road, virtue the longer one. In other words, cutting corners is dishonest.”

Used-car salespeople have throughout history made a living on hiding risk. The same goes for all the bankers in the 2008 crisis. They literally know some portion of information that is directly against the dominant narrative they are trying to profit from, so they hide that from the buyer and laugh all the way to the bank.

This asymmetry in risk bearing leads to imbalances and, potentially, to systemic ruin. This idea being a central component to systems becoming increasingly fragile, and the accumulation of such leading to Black Swan events — due to that fragility being unknown to the user.

“Modernity put it in our heads that there are two units: the individual and the universal collective — in that sense, SITG for you would be just for you, as a unit. In reality, my skin lies in a broader set of people, one that includes a family, a community, a tribe, a fraternity. But it cannot possibly be the universal.” “Win and help win” is an upgrade from “Live and Let Live.”

Rationality in Complex Systems

This is about survival, evolution, and the deeper and statistical over time.

“Do not pay attention to what people say, only what they do, and to how much of their necks they are putting on the line.” That is the only real “rational agent” in a system - survival.

Systemic Learning is not from individual learning, but evolution through selection!

“Systems don’t learn because people learn individually –that’s the myth of modernity. Systems learn at the collective level by the mechanism of selection: by eliminating those elements that reduce the fitness of the whole, provided these have skin in the game. Food in New York improves from bankruptcy to bankruptcy, rather than the chefs’ individual learning curves –compare the food quality in mortal restaurants to that in an immortal governmental cafeteria.”

SITG is NOT just about having a share of the benefits (like in finance), but it is really about symmetry - having a share of the game —and promoting better decision-makers rather than giving you better decision-making skills.

The graphic below succinctly conveys who the “wrong enemy” is, an abstract and overarching term with no meaning: “The rich,” against who the “right enemy” is by using our SITG rubric as a specific delineation between them: Earners & Predators, Entrepreneurs & Cronies, Protectors & Rent-seekers."

The people, or groups of people, on the right of the graphic are who we should be putting pressure on. We should also be creating systems that effectively make it hard, if not impossible, to NOT have Skin In The Game!

—

What Lindy Told Us—

“The Lindy Effect” is another heuristic popularized by the author that tells the story of Broadway actors predicting how long a play would last on the most famous theatrical street in the United States.

It loosely said that the future life expectancy of the play (in days), or how long it would play “On Broadway,” was double the number of days it had already lasted on Broadway. Book of Mormon, for example, has run for 100 days, so the heuristic would be that Book of Mormon would run for 100 more days. And on, and on…

When something is “Lindy Proof,” “Is Lindy,” or is “Lindy compatible” it shows that something seems to belong to the class of things that have the following property: It ages in reverse-- i.e., its life expectancy lengthens with time, conditional on survival.”

This has incredibly profound consequences for our modern world view Taleb says, “thanks to Lindy, no expert is the final expert anymore and we do not need meta-experts judging the expertise of experts one rank below them. We solve the “turtles all the way down” problem of infinite regress. Fragility is the expert, hence time and survival are our guideposts of success.”

Taleb finishes his 5th installment of the Incerto, with the maxims below - via negativa style - to summarize the “Lindy Effect,” “Antifragile,” “Black Swans,“ in culmination with “Skin In The Game.”

“No muscles without strength,

friendship without trust,

opinion without consequence,

change without aesthetics,

age without values,

life without effort,

water without thirst,

food without nourishment,

love without sacrifice,

power without fairness,

facts without rigor,

statistics without logic,

mathematics without proof,

teaching without experience,

politeness without warmth,

values without embodiment,

degrees without erudition,

militarism without fortitude,

progress without civilization,

friendship without investment,

virtue without risk,

probability without ergodicity,

wealth without exposure,

complication without depth,

fluency without content,

decision without symmetry,

science without skepticism,

religion without tolerance,

AND, most of all:

nothing without skin in the game.”

Text:

1) Skin In The Game: Hidden Asymmetries In Daily Life by Nassim Nicholas Taleb

“From the New York Times bestselling author of The Black Swan, a bold new work that challenges many of our long-held beliefs about risk and reward, politics and religion, finance and personal responsibility

In his most provocative and practical book yet, one of the foremost thinkers of our time redefines what it means to understand the world, succeed in a profession, contribute to a fair and just society, detect nonsense, and influence others. Citing examples ranging from Hammurabi to Seneca, Antaeus the Giant to Donald Trump, Nassim Nicholas Taleb shows how the willingness to accept one’s own risks is an essential attribute of heroes, saints, and flourishing people in all walks of life.

As always both accessible and iconoclastic, Taleb challenges long-held beliefs about the values of those who spearhead military interventions, make financial investments, and propagate religious faiths. Among his insights:

• For social justice, focus on symmetry and risk sharing. You cannot make profits and transfer the risks to others, as bankers and large corporations do. You cannot get rich without owning your own risk and paying for your own losses. Forcing skin in the game corrects this asymmetry better than thousands of laws and regulations.

• Ethical rules aren’t universal. You’re part of a group larger than you, but it’s still smaller than humanity in general.

• Minorities, not majorities, run the world. The world is not run by consensus but by stubborn minorities imposing their tastes and ethics on others.

• You can be an intellectual yet still be an idiot. “Educated philistines” have been wrong on everything from Stalinism to Iraq to low-carb diets.

• Beware of complicated solutions (that someone was paid to find). A simple barbell can build muscle better than expensive new machines.

• True religion is commitment, not just faith. How much you believe in something is manifested only by what you’re willing to risk for it.

The phrase “skin in the game” is one we have often heard but rarely stopped to truly dissect. It is the backbone of risk management, but it’s also an astonishingly rich worldview that, as Taleb shows in this book, applies to all aspects of our lives. As Taleb says, “The symmetry of skin in the game is a simple rule that’s necessary for fairness and justice, and the ultimate BS-buster,” and “Never trust anyone who doesn’t have skin in the game. Without it, fools and crooks will benefit, and their mistakes will never come back to haunt them.””

2) The Skin In The Game Heuristic for Protection Against Tail Events (Original Paper) by Nassim N. Taleb & Constantine Sandis

“Standard economic theory makes an allowance for the agency problem, but not the compounding of moral hazard in the presence of informational opacity, particularly in what concerns high-impact events in fat tailed domains (under slow convergence for the law of large numbers). Nor did it look at exposure as a filter that removes nefarious risk takers from the system so they stop harming others.(In the language of probability, skin in the game creates an absorbing state for the agent, not just the principal). But the ancients did; so did many aspects of moral philosophy. We propose a global and morally mandatory heuristic that anyone involved in an action which can possibly generate harm for others, even probabilistically, should be required to be exposed to some damage, regardless of context. While perhaps not sufficient,the heuristic is certainly necessary hence mandatory. It is supposed to counter voluntary and involuntary risk hiding−and risk transfer−in the tails. We link the rule to various philosophical approaches to ethics and moral luck.“

Audio:

Books of Titans podcast talking about the book “Skin In The Game”

Made You Think podcast talking about the book “Skin In The Game”

Radiolab podcast talking about the idea of “Skin In The Game”

Video:

Playlist

https://www.youtube.com/playlist?list=PL8ADA5JhLe2-eBXZoWFHVQkmuO_Uj66qq

—

1) EFN - Nassim Nicholas Taleb on Skin in the Game

2) The Swedish Investor - SKIN IN THE GAME SUMMARY (BY NASSIM TALEB)

3) Talks at Google - Nassim Nicholas Taleb: "Skin in the Game"

4) Ron Paul Liberty Report - 'Skin In The Game' with Special Guest Nassim Nicholas Taleb

What’s Next?

The next newsletter will be on: Emile Durkheim’s Theory of Anomie

If you enjoyed this post, please share with other potential eclectic spacewalkers, consider subscribing or gift a subscription, or connect with us on social media to continue the conversation! Also, I am an advocate of Bitcoin. My address is on my About.Me page if you are feeling extra curious.

Subscribe to Substack Newsletter

Listen to all podcasts on Anchor

Follow Eclectic Spacewalk on Twitter

Follow Eclectic Spacewalk on Medium

Thank You for your time. Until the next post, Ad Astra!

good